The Bitcoin Bubble And Blockchain Bonanza

A Word About Bubbles.

What is Blockchain and Should I Care?

Picks and Shovels.

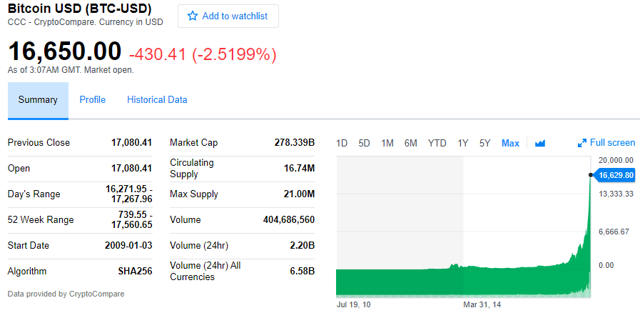

(Accessed via Yahoo! Finance, 12/12/2017)

Heard of Bitcoin lately? Stories of multi-millionaires who bought at $.30/bitcoin are a dime a dozen right now, as FOMO whips the market into a frothy frenzy. Should you get in?

I work in the payments industry, facilitating exchange from one currency into another for individuals who need euros/pounds/yen, etc. for the currency or currencies they have in their bank accounts. Day in and day out I watch fluctuation of these currencies in relation to each other, and night after night I do my research around security opportunities for investments. This blend of both worlds gives me a nice platform of knowledge to soapbox a bit about cryptocurrencies (crypto from here on out for brevity). Take that as you will.

This article has two simple goals: I want to first establish something that should be obvious, that Bitcoin is a stereotypical bubble, and what that means to those holding the cryptos (Bitcoin, Litecoin, Ethereum, Dogecoin, to name a few). Secondly I want to explore the objective opportunities of the technology that underpins cryptos and differentiate the opportunity from the status quo in my eyes. All comments are welcome, whether contrary or affirmative.

The Bitcoin Bubble

Before I dive into this a bit, let's define a bubble, since it's such a fun term to bandy about hither and thither. The Nasdaq gives us a handy definition:

A market phenomenon characterized by surges in asset prices to levels significantly above the fundamental value of that asset. Bubbles are often hard to detect in real time because there is disagreement over the fundamental value of the asset. (http://www.nasdaq.com/investing/glossary/e/economic-bubble)

So the first thing to define is the fundamental value of bitcoin as an asset. This is tricky as it's a cyclical definition. An asset is something that has value in exchange, and the value of that asset in this case (Bitcoin) is determined by...what?

Technically the value at the time of writing is around $16,650 for one Bitcoin. This, however, is just the value of the asset expressed in terms of another asset. Fundamentally, the value of Bitcoin is tied to its transaction power and the prospects of that power in the future (similar to a company's future cash flows).

I would posit that the current transactional volume of Bitcoin is entirely disregarded by anyone currently buying Bitcoin. Speculators are not buying Bitcoin in order to use it to pay for what they shop for on Amazon, or for paying their mortgages; they are buying Bitcoin to potentially profit from a quick and steep appreciation of price. This is pure and simple a profit play with no perceived margin of safety. We'll shelf the value of the anticipated power for transaction for now and come back to it in a bit.

If you need a bit more prodding to be convinced, here are a couple quick points regarding bubbles:

- as the Joe Kennedy axiom goes: "You know it's time to sell when shoeshine boys give you stock tips. This bull market is over." People are taking out mortgages to buy bitcoin.

- As highlighted before, people are buying bitcoin to make a large and swift profit. Their plan is then to take those gains and put them back into U.S. Dollars, Euros, or whatever other true currency they use in their daily lives.

- A great number of people are buying Bitcoin who have no idea of its practical applications (how it is mined, how the public ledger works, etc.).

Thus in a simplistic sense as in the definition above, Bitcoin is by definition a bubble as its intrinsic purpose is not the main catalyst of investment. The thing is, people know this Just look at the chart at the top of the page again for a refresher.

When faced with the fact that Bitcoin rose from 1K to 19K (at its height so far) in the past year, those that are considering buying in in my circles commonly tell me that they'll just put a little money in and ride it out. If they lose money, they lose money. Can the bubble keep going? Sure it can. The dotcom bubble went on far after experts started crying bubble. When that bubble pops, and pop it will, all those people that put a little money take it out and all that liquidity evaporates. That's just what happens when everyone buys something to sell it to a greater fool.

Blockchain is the Real Deal

Bitcoin is a tip of a massive disruptor that the titanic banking system is cruising straight towards. I said earlier I work in payments. The current ACH system in use in the United States has been around in much its original form for several decades. The system is a convoluted one, that facilitates transactions through a central clearing house's ledger for a debit from one account and credit to another. This antiquated system takes about 2-3 business days to clear. The estimated volume is $43 trillion per year.

So what does Blockchain do? Blockchain is a public ledger wherein all accounts are linked together as one cohesive string of balances. When a transaction is entered into the blockchain, a unique event is entered into the public ledger where node A is increased by an amount and node B is decreased by the same amount instantaneously. These transactions are irreversible; to reverse the transaction a new credit/debit between the accounts would be entered into the chain. Every "node" is accessed by the user who holds that wallet.

Think of blockchain as a linked straight line of connected accounts, and the ACH system as an octopus with the center being the Clearing House, and tens of thousands of arms leading from this to the banking institutions around the world. The possibilities that arise from instant transactions from anywhere around the world is an instant disruption for the better to the financial services industry, and has wide-reaching implications across a great number of industries (more in a minute).

Where are the Bitcoin Picks and Shovels?

If Bitcoin is the gold rush right now, blockchain is your worldwide picks and shovels depot. Bitcoin, Litecoin, Ethereum, these are all just individual manifestations of blockchain technology, and this is the biggest technological innovation since the internet.

So, if one is wary of buying cryptos but believes in this nascent technology and its future applications, how does one invest in blockchain? Well since it is still such a new venture, that's difficult if you don't have own a venture capitalist firm, as these companies have not to a large part become available to invest in on the public market. Fear not, because a publicly-listed company has quietly and effectively created its own blockchain venture capital subsidary: Overstock.com (OSTK).

Those who remember the old Overstock remember it as a relatively successful wholesale eCommerce company (back before Amazon became a juggernaut). The prospects of the eCommerce business are certainly not bright. You aren't buying Overstock for it's marketplace, you're buying it for it's ownership of Medici Ventures.

Patrick Byrne, CEO of Overstock, set up this wholly owned subsidiary in 2014 solely to invest capital in startup companies springing up to use blockchain technology. Take a look at the companies that Medici Ventures has a share in. They span the industries of capital markets, money and banking, identity, land, voting, underlying tech. Quite the dartboard.

Where to Go from Here

As with all investments, do your due diligence before putting your hard-earned money anywhere. Though I believe in the blockchain technology, I'm not going to say get out there and buy up Overstock. Look at the prospects, assess your risk profile and what your most well-informed judgment calls for in regards to your investment portfolio. For me it's the only way I've found to invest in a basket of blockchain companies.

I would be amiss when speaking about a "basket" to leave out mention of the Bitcoin Investment Trust (GBTC). GBTC is a publicly traded trust that holds bitcoin, and thus is seen as a proxy to investing directly in Bitcoin. I urge caution in putting money there, as the premium (market value in relation to the underlying value of the bitcoin held on open market) is currently over 20%, and has been over 40%. If you really want to buy bitcoin and this article has not dissuaded you, just invest directly in bitcoin via the payment wallets you can find.

Who knows, Bitcoin may end up swallowing up all other cryptos and all major corporations might start accepting it as payment. Your guess is as good as mine. My sneaking suspicion is that this first mover is only the fastest horse out of the gate, and there is a lot of race to run. Don't let it run away with you.

Comments

Post a Comment